What currency pairs to trade in Forex?

Although there is lots of currency pairs offered to Forex traders, if you are a beginner it is easier to start with major currency pairs:

EUR/USD

GBP/USD

USD/JPY

There are several good reasons for that:

1. These currency crosses are widely traded, thus providing liquidity which is needed in order to benefit from price changes.

2. They have tight spreads, except may be for GBP/USD, which most of the time receives higher spread quotation from Forex brokers as it is more volatile (e.g. has wider price ranges than other pairs).

3. They all are traded against US dollar, which automatically suggest that the most active trading hours would be during New York trading session – the session with the highest volume of trades.

4. And finally, there are many Forex trading systems that are developed for trading those pairs and can be found online.

What currency pairs to avoid?

Exotic and uncommon currency pairs should be avoided by novice Forex traders as some further knowledge is needed to trade such pairs successfully.

Here is the list of major currencies beginner traders should focus on:

Euro (EUR)

US Dollar (USD)

British Pound (GBP)

Swiss Franc (CHF)

Japanese Yen (JPY)

Australian Dollar (AUD)

Canadian Dollar (CAD)

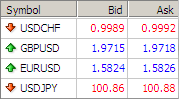

Also novice Forex traders should try to avoid currency pairs which have high spreads. Spreads vary from broker to broker. The information about spreads can be found at brokers’ websites, or at the special column called “Spread” on the trading platform itself, or from the Ask/Bid table (found also on the trading platform) by subtracting Bid price from the Ask.

Here is an example:

On the screenshot we have USD/CHF spread = 3 (Ask – Bid = 0.9992-0.9989 = 3)

GBP/USD spread = 3

EUR/USD spread = 2

USD/JPY spread = 2

Currencies that have high spreads are more volatile, e.g. have wide price ranges and longer price spikes, which unprepared traders may find difficult to trade.

Also a common mistake done by many beginner traders is that they try to monitor too many currency pairs at once. Not only it makes trading hectic and more difficult to manage, it also prevents deeper analysis of the currency pairs and actually learning their “behavior” over the time.

Currency pairs do have their unique ways to move, react to economical events, form trends etc.

By studying one currency pair at the time, Forex traders have the ability to observe its behavior and learn the ways to trade the pair even more effectively.

how about explaining a pairs trade that might be a good start for a beginner.

3 easiest pairs are: EUR/USD, USD/JPY and GBP/USD.

EUR/USD - most popular pair with the lowest spread. This pair is an ideal choice for beginners, since it responds quite well to basic technical studies and rules, which traders learn in the beginning. EUR/USD is not too volatile under normal market conditions and, thus, can be traded safely with lesser risks and closer stops.

From the fundamental point of view EUR/USD gets lots of global economic coverage, it is an easy to follow and monitor pair.

USD/JPY is another good currency pair. It often has the same low spread as EUR/USD, which makes it attractive to investors. USD/JPY pair features much smoother trends, comparing to other pairs; this makes trading USD/JPY during trends a real joy, not to mention the fact of earning profits alongside.

The behavior (trend) of USD/JPY pair can also easily be compared/verified with other /JPY pairs, for example, EUR/JPY, CAD/JPY or GBP/JPY.

GBP/USD - this currency pair likes large moves, it is able to bring more pips in one simple move than EUR/USD or USD/JPY. It is a pair often used for breakout trading. However, the risks here rise proportional to profit opportunities. GBP/USD requires further away placed stops. It belongs to volatile pairs group.

There is also plenty of market research and analysis available for GBP/USD, which makes it favorable among traders.

Every trading system would behave differently with different currency pairs. Stops, Profit levels, risks - everything should be calculated and tailored individually for each pair if you are looking to get the best performance out of each trade.

Which of the broker can you start with $50 dollars for trading

Have a look at this list of Forex brokers with mini-accounts

I'm confused, Question: for instant I know USD price supposed jumped up. what is my act for eur usd buy or sell ? please ....

sell

I prefer to let my indicators highlight which ones fit my strategy rather than just sticking with one currency.A quick look over them at night time and i pick the few or none that meet the strategy.

EUR/USD means euro is your base currency ie if dollar strengthens against the euro the euro/dollar price ratio goes down

with all forex brokers do you only lose the money you invest????? I realise there is leverage, but can you end up owing money?????

sell, with currency pairs the one which is quoted first will strengthen as the pair moves up and weaken as the price goes down. which means the usd will do the opposite

WHILE I TRADE WITH EUR/USD @ 1.3930 AND NOW RATE IS 1.3940 MARKET CLOSED WHAT WILL HAPPEND, CAN YOU EXPLAIN THE MARKET IS REOPEN WHAT WILL HAPPENED

Quote: with all forex brokers do you only lose the money you invest????? I realise there is leverage, but can you end up owing money?????

No, never. You have a set amount of margin available from your funds and you have to stick to the margin rules. If you go over them, the trade is closed automatically. You can never end up owing your broker, the cash has to be in your account before you trade.

guys i am a forex newbie. could you guys suggest some useful websites that i can practice first without using real money. and also do you guys suggest etoro......? is it a scam or is it legit?

i,m confused about jyp/usd or usd/jyp currency.i think give a good advice for new traders.

Based on these questions I wouldn't bother trading you will only loose

i newbie too what should i trade gbp/usd or other.should buy or sell .any1 help?

So why do some currency pairs like EUR/CAD GBP/JPY EUR/CHF have a bigger spread than others like the EUR/USD?

can someone explain what happens over the weekend. for example i bet on a friday the usd/euro would not touch a certain level and this bet closes on a monday.

but are there factors (such as natural disasters) which would cause it to open monday at a completely different level?

or are the first few hours on a monday usually the most volatile ones in which the most devaluation takes place?

I need to trade currency for the cnbc portfolio challenge, andy suggestions on what 2 buy?

forexbeginners.net " Thank you for providing vital informations for forex Trading.

I have been researching for a firm which offers dealing in the Kenya shilling and so far I have not been succesful.Would you assist me?

DO you think if we open account with forex trading(buying and selling) and options account and differently and organize the trade in between them we will actually make real profit and easy profit?

The First Currency is the Base Currency, for example JPY/USD here JPY is the Base Currency, if market goes up for this pair (JPY/USD) means, JPY dollar is Increasing like that Market goes down for this pair (JPY/USD) means JPY Dollar is decreasing

you apply the same concept to any other pair

EUR/USD

Here EURO is the Base Currency, if Market price goes up means EURO Dollar was increasing, Market Goes down EURO Dollar price getting down.

Hope you understand

guys i am a forex newbie. could you guys suggest some useful websites that i can practice first without using real money. and also do you guys suggest etoro......? is it a scam or is it legit?

that makes two of us bud...i have been reading a lot of horrow stoies and thinking i may be getting out b 4 i get in, it seems i can never meet some one who would give me a couple good leader tips just to get started and make a couple bucks, i beleave in education is not free, but with no one willing to get off any hints or tips, waiting tables is starting to sound safer....i want to start with a 100 bucks and try to build it up, i am a wage earner trying to get a education...

usd/jpy open price 77.511 amount 10k sell position it will take how many pips it will take min profits ?

I am a beginner in forex and I am looking for a mentor to help me thru my trading

Is it possible to have someone trading for you and you sharing the profit let say 15 -20%?

This is confusing

The spread is the difference between the bid and ask price why is it so important?

What for it is to be trade inpairs ?

thanks for the info guys, it came in handy, wish you guys the best of luck in trading. maybe we'll meet someday and not know we shared info online.

does anyone have any advice on hedging a use.jpy that had gone terribly wrong?

USD/JPY = If US news is positive, you should BUY (BUY dollar, sell yen), If US news is negative, you should SELL (SELL us dollar, buy yen)